By Abigail Robson of Amber Gaming (Isle of Man)

On 9th December 2021 the Gambling Commission of Great Britain (GC) published its annual Compliance and Enforcement Report (Raising Standards for consumers - Compliance and Enforcement report 2020 to 2021 - Gambling Commission), featuring the findings of the regulator’s extensive investigations against licence holders from the past year.

The fundamental principles of the GC is to make gambling safe and prevent it from being a source of crime or used to support crime whilst ensuring it is conducted in a fair and transparent manner. This enforcement report has shown once again that they will not hesitate to crack down on operators who are not compliant. Therefore, it is imperative that regulatory objectives remain at the forefront of the operators mind.

Following this recent publication, Amber Gaming have created a training module to fully inform and update you about the key findings of the GC, including where operators have neglected their regulatory obligations alongside highlighting key legislation and areas for improvement. This article will provide you with an overview of the GC’s recommendations and provide recommendations on how you can become more compliant.

Background/Key Actions

Within the report, the GC has recognised that this has been a particularly challenging year for all in dealing with the impacts of the Covid-19 pandemic, however this has not halted the GC from continuing their work throughout.

For the GC, this has been one of their busiest years. They have completed:

The above has resulted in multiple licence suspensions, revocations, and a total of £32.1 million payable in lieu of fines and regulatory settlements split across 15 operators – this is more than any previous year.

The Enforcement Report is a comprehensive document, to aid clarity and understanding the report is broken down into five key areas:

AML & CTF

Looking back at action taken in 2020/2021 there are two common trends for weaknesses, operators failing to comply with both social responsibility and anti-money laundering rules. GC Chief Executive Andrew Rhodes said that casework has revealed many operators aren’t allocating sufficient resources to these areas or are failing to put regulatory objectives ahead of commercial objectives.

An excerpt from Abigail Robson as she shares her findings on the Gambling Commission annual compliance and enforcement report.

An excerpt from Abigail Robson as she shares her findings on the Gambling Commission annual compliance and enforcement report.

Importantly, the GC wants operators to focus on ensuring risk assessments, policies, procedures and controls are fit for purpose in line with the Gambling Act 2005. There were increasing instances of gambling operators failing to consider how problem gambling can be linked to ML and TF despite the GC’s Guidance for remote and non-remote casinos stating, “a pattern of increasing spend or spend inconsistent with apparent source of income could be indicative of ML, but also equally of problem gambling, or both”.

Recommendations include:

Operators should make use of all GC-issued guidance and applicable learning, for example emerging risk bulletins, to mitigate the risk of failure to identify and assess money laundering (“ML”) and terrorist financing (“TF”) risks. The quality of suspicious activity reports (“SARs”) and the obligations and proficiency of the Nominated Officer and Money Laundering Reporting Officer will continue to be a focus for the GC’s AML team.

An example of an online operators failure to fulfil the relevant obligations is that when investigated, a customer from a high risk third country was found with pre-paid cards under 36 different identities. Some were linked to gambling activities with online betting operators. There are notable enforcement cases including an operator making a payment of £1,334,053.18 for AML and social responsibility failings.

In October 2020 the GC introduced new and amended Licence Conditions regarding AML and CTF, it will be a future focus of the GC how well operators have implemented these and the overall impact it has on the industry. The Enforcement Report highlights that operators must:

Licensed Operators and Financial Stability

Given the significant challenges posed by the pandemic, the GC wasn’t surprised by the increase in gambling operators, particularly land-based, struggling financially. During those times the GC urges licensees with financial stability issues to come to the GC at the earliest stage, being mindful of LCCP obligations and customer protections.

When there is a planned closedown of a business, or its long-term viability is questionable, the primary focus of the GC will be ensuring consumers are treated fairly. Licensees should:

Special Measures and Licence Suspensions

This pilot scheme, in place since September 2020 had eight operators involved, seven of which had demonstrated significant improvements. The remaining licensee is now the subject of casework, which may result in a formal review. Based on the scheme thus far, a decision has been made to extend the pilot until spring 2022 with the view of making it permanent.

Personal Licence Reviews

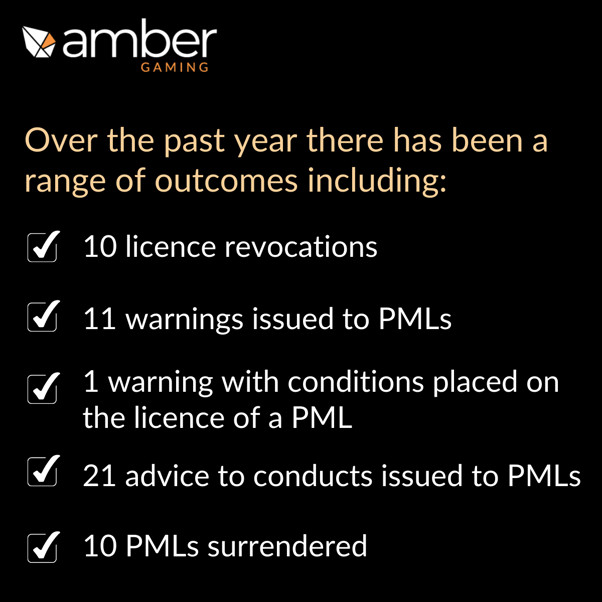

Licensees must remain diligent when appointing Personal Management Licence (“PML”) holders, the GC takes a strict approach when considering regulatory failings. Not only must there be thorough checks conducted before appointment of a new PML holder, but also whilst they are in their position. From the report the GC has shown they will remain strong in their approach. Over the past year there has been a range of outcomes including:

The GC has noted some key issues such as inadequate curiosity and oversight over customers source of wealth and/or source of funds by PML holders and a delay or failure to report a parallel SAR Key Event to the GC.

An important point to note is that concerns have been highlighted by the GC relating to senior management having insufficient oversight of their company’s assessment of the risks it faces in terms of ML and TF.

PML’s are regulated under the Gambling Act 2005. As a result, PML holders must ensure reasonable steps are taken to avoid any licence conditions breaches.

Any changes in key positions should be communicated to the GC and where applicable the person in question should submit a personal licence application.

Illegal Gambling

The GC has noted a 17% increase in complaints reported from members of the public relating to the allowance of gambling, with refusal to pay out being reported at a consistent level with previous years. Support given to police forces with investigations, advice provision via NPCC stakeholder engagement and engagement with other international regulators will continue to help raise the prominence and tackle the issue.

Conclusion

As highlighted above, there are a number of recommendations and lessons for operators to learn from within the Enforcement Report.

Please get in touch with us to obtain access to this GC Enforcement Report microleaning and our other suite of market ready courses (such as AML, Responsible Gambling and Information Security amongst others), and to discuss how you and your staff can prepare for and look ahead to updates with our training and compliance frameworks.

Contrast

Contrast

Text size

Text size